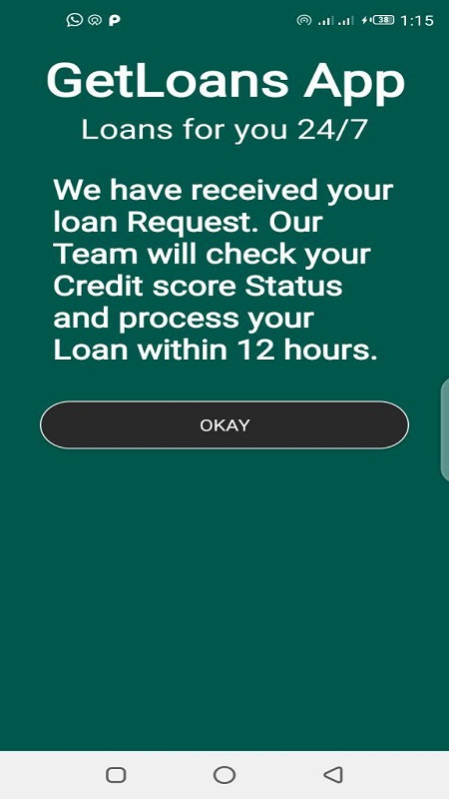

GetLoan - Leading Lending Apps Kenya 1.0

Continue to app

Free Version

Publisher Description

According to research, most people survive on mobile loans in Kenya. It is now easy to get instant unsecured loans through Loan Apps in Kenya. Getting personal loans online in Kenya is now faster and easier than getting a traditional bank loan thanks to the introduction of Mobile Banking.

Customers who need to borrow a small personal loan for an amount between Ksh 100 and Ksh 50,000, will have an instant approval with money deposited directly into their Mpesa accounts.

1. Mshwari

Mshwari is a Mobile banking service offered through M-Pesa in partnership with the Commercial Bank of Africa (CBA).

The minimum loan amount that can you can borrow is Ksh 100, and the maximum loan limit is unknown. To qualify for a higher loan limit; one is required to have repaid the first loaned amount on time, and also increase your saving amount in your account.

Mshwari loans usually have a repayment duration of 30 days and attract an interest rate of 7.5%. Loan disbursement is done through Mpesa and processed in less than five minutes.

2. KCB M-Pesa

KCB Mpesa is a partnership between the Kenya Commercial Bank (KCB) with Mpesa through Safaricom. The loan platform started in 2015 as a saving account and has been active ever since. It is possible to borrow without saving, and the loan disbursed through KCB Mpesa Menu on your phone.

3. Tala (Formerly Mkopo Rahisi)

Tala loan app was the first instant mobile loan app launched as Mkopo Rahisi in 2014 and later rebranded to Tala. This app requires one to have a smartphone and a good Mpesa Track record to access their loans.

4. Branch

Branch International Inc is a San Fransico based company with a branch in Nairobi. It was launched in Kenya in 2015 and has been active ever since.

To qualify for a loan using this app, you need to be a registered Mpesa user and have an official active Facebook account with usernames matching those in your National ID card.

5. Saida

Saida is also using a mobile app to grant loans just like Tala and branch. To be eligible for a Saida Loan, your Mpesa/Airtel Money accounts must be very active. The app reads and monitors your transaction and calls activities to determine if you can be able to repay their loan.

6. OKOA Stima

Okoa Stima was founded by Kenya Power in partnership with Safaricom in 2015 and is currently active. It comes in handy when you don’t have enough fund to pay for electricity.

About GetLoan - Leading Lending Apps Kenya